The supply of affordable homes on the market rose a record 13% in the third quarter as mortgage forbearance programs ended, prompting low-cost homeowners to put their properties on the market, according to a recent Redfin report.

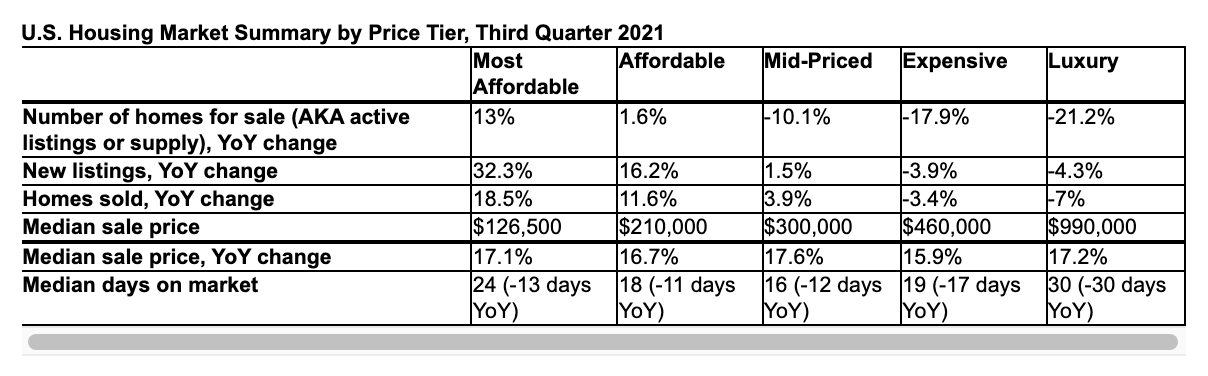

Taking residential properties across the country and dividing them into five price tiers based on the company’s home market values estimates, Redfin found the supply of homes in the affordable price tier showed record growth, up 1.6% year over year, while housing supply in the other segments fell. The five segments include most affordable, affordable, mid-priced, expensive and luxury price tiers. Homes in the luxury market and expensive market also had record drops in the third quarter of 21.2% and 17.9%, respectively.

“The end of forbearance has forced many lower-income Americans to put their homes up for sale and become renters,” Redfin Chief Economist Daryl Fairweather said in a press release. “This has caused the number of affordable homes on the market to surge, helping replenish inventory amid an acute housing shortage. It’s a rainstorm after a long drought, but the drought isn’t over yet.”

The report found the housing supply in the most affordable and affordable tiers continues to be below historic levels despite the increase. In the third quarter of 2021, there were 78,000 active listings in the most affordable tier, compared to more than 100,000 during the same quarter from 2013 to 2016. There were 158,000 active listings in the luxury tier, the fourth lowest on record.

High-end home sales fell for the first time in more than a year due to several factors including lack of high-end housing inventory.

Despite the housing shortage limiting home sales, homes across all price tiers are still selling faster and for more than they were a year ago indicating buyer demand continues to remain strong.