Anne Hartnett

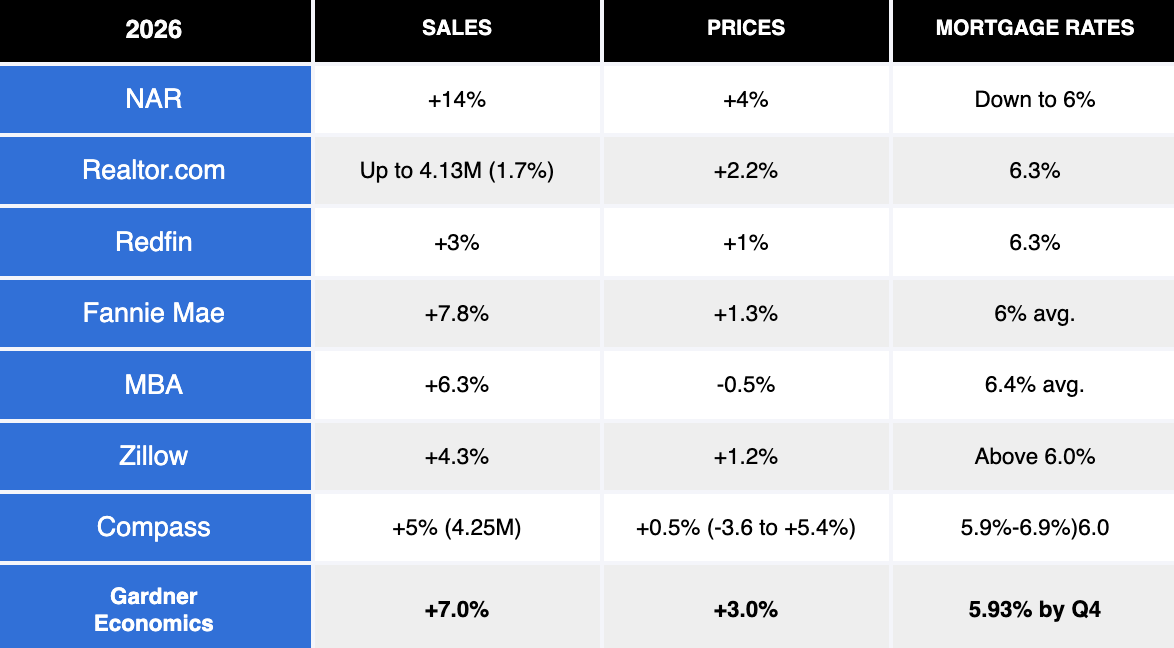

Hi, I’m Anne Hartnett with Agent Publishing. Today we’re taking a closer look at what the 2026 housing market may actually look like based on the latest forecasts coming from across the industry. I’m joined today by Matthew Gardner, chief economist at Gardner Economics, to break down where those predictions align, where they differ, and what they really mean to real estate professionals heading into 2026. Thanks for joining me today, Matthew.

Matthew Gardner

You are welcome, and good to see you again.

Hartnett

Almost every forecast agrees more homes will sell in 2026. The disagreement isn’t if — it’s how fast. What’s driving that range of optimism and what ultimately determines how quickly transaction volumes will actually return?

Gardner

That’s a great question, and to be honest with you, it couldn’t really get any worse. The last couple of years, sales have been really remarkably, remarkably low. So why are we going to see a change in that? Well, there’s a couple of reasons, one of which is I expect to see inventory levels rise a bit more. Therefore, there’s going to be more choice in the marketplace. That obviously is a good thing. But more importantly, I think, is that I expect that home sellers, they’re going to start becoming a little bit more, shall we say, realistic when it comes to the value of their homes. So if you start seeing some lower asking prices, well, naturally you can have home buyers or potential buyers watching, and I think we’re going to see increased sales because of that. But I also see there’s one other driver that no one’s really talking about. And that is going to come in the form of who I call “fence sitters.” Now, these are would-be buyers, and they’ve been waiting on the sidelines. And quite frankly, they’ve been waiting for one thing to happen, and that’s a housing market that’s going to collapse, and therefore they could pick up a home remarkably cheaply. Well, I think they’re now saying, well, maybe they know that’s not going to happen and the market’s not going to implode. And because of that I think they’re going to start getting more active in the marketplace as well. So when you combine greater inventory but more importantly greater demand, that means I expect to see a decent but not huge jump in the number of sales in 2026 over 2025 levels.

Hartnett

The industry agrees prices will hold, not surge, signaling balance, not distress. Is 2026 the year we finally stop talking about price acceleration and start talking about price normalization?

Gardner

I’m not sure that 2026 will be best described as balanced. Because I think there’s going to be plenty of markets where affordability is still going to be a very significant issue. And there are also others where we haven’t seen price drops, quite frankly, bottom out. That said, I certainly see prices being able to rise nationally a little bit more. Yes, it’ll be somewhat modest growth, and the reasons for that are going to be somewhat similar for the reasons that I expect sales to increase. Greater confidence in the marketplace will be one. We’re also seeing modestly lower borrowing costs and improving affordability in certain markets, but mainly it’ll be improving affordability because asking prices are quite likely to pull back a little bit further. And price growth also, it will go up a bit nationally, but it’s going to vary fairly significantly by region. And I expect that home prices in the Midwest, which is classically more affordable than the rest of the country, I think they can raise quite nicely, but they’ll be very modest gains in the northeast and in the south, while out west, where prices actually declined in 2025, I see them turning modestly positive in 2026. So the bottom line here, as far as I see it, is that incomes will be rising, likely a little bit faster than home prices. That’s good for affordability, but I think it’s going to take several years of this trend of very low price growth and far higher wage growth. Before we can say that the market is even close to being normal. I just don’t see that happening for quite some time. And because of that, I think it’s still going to be a fairly hard environment for all those would-be first-time buyers out there.

Hartnett

Most organizations are predicting rates in the low- to mid-6% range. Matthew, you predict the lowest rate of 5.9% by Q4 2026. What’s driving that outlook and what would need to happen for rates to move meaningfully lower or higher?

Gardner

Well, the primary reason that I think the rates can drop from where they are today is that although I don’t see bond yields moving much, and as we all know, mortgage rates are based on the yield on ten-year treasuries. But what we have seen is the spread between ten-year paper and mortgage rates tighten and really kind of start heading back closer to the historic average the spread was between them — that 1.8%, 1.9%. So what that means is we could actually see bond yields not move very much at all. But mortgage rates can come down if that spread continues to narrow. So yes, I think that we could likely — not guaranteed — possibly getting just marginally below 6% by the end of 2026. Now, what it would take to move significantly below that? Well, I mean, I’d be careful what I wish for. And the reason I say that is that if rates are going to drop down or could drop down into, let’s say, the mid- or low-fives, well, it would likely mean we are already in a very significant economic contraction, AKA a recession. So be careful what you wish for. On the other side of the equation, rates moving palpably higher — I really don’t see any reason for that to happen. It certainly could, and it would have to be because yields on treasuries have jumped, and that would only come from one reason and one reason alone. And that is a lack of belief in U.S. debt. I’m hopeful that that will not be the case. So because of all these factors, yes, I think modestly lower rates. Yes, I think we can get into the high fives. But I certainly do not expect rates to move significantly higher from where they are today.

Hartnett

NAR stands out with a forecast of 14% sales growth, roughly double what many portals and economists are predicting. Why is NAR so much more optimistic on transaction volume, and do you think that optimism is warranted?

Hartnett

Oh, I do like Laurence [Yun], however, and I say that chief economist, a nice guy. But, I really, quite frankly, don’t share his optimism. Now, it is interesting, though. I mean, most of us are looking in that 2% to 4% growth. I’m a bit more bullish than that, but no one’s in double digits. Now reading what he has put out, what NAR’s published, is that he’s looking at, quite frankly, the same reasons that I see sales able to rise in 2026: falling mortgage rates and higher inventory levels unlocking, in his opinion, pent-up buyer demand. But I mean, a 14% increase means to me that — rough math — we’d have to see sales transactions jump by close to 600,000 units. I admire his enthusiasm and his optimism, but I quite frankly don’t see any reason that would happen other than a very, very significant downturn in overall prices or in mortgage rates. And because I don’t expect to see that occurring, I think he’s a bit optimistic. But you know what — and as always — time will tell.

Hartnett

Most forecasters offer fairly tight ranges for mortgage rates, but Compass predicted a wide band, from roughly 5.9% to 6.9%. Does that reflect increased caution, or simply a more realistic view of volatility?

Garder

Well, I mean that obviously a very significant range that they’ve put out there, and I think that their position, and certainly I don’t want to talk for them, is that they’re offering really two scenarios: a bullish scenario, whereby we could see, mortgage rates drop down below 6%, or a bearish one, meaning that we could say rates jump up to, I think they said 6.9%. And they did the same thing with sales, which they forecast being somewhere from sales falling by 3.6% or rising by 4.6%. I think that what they’re looking at as far as mortgage rates go is that they’re looking at ten year treasuries, which is appropriate. They’re saying that could range from 4% to 4.8%. Therefore that means that mortgage rates will come in at that 5.9% to 6.9%. But they do give a single number, which is in essence the average of the two, so really they’re saying 6.4%, but at a very wide average. Now, if the economy slows as we talked about, are we heading to a recession? Certainly. Rates can drop because we will see a big move out of people moving money out of equities and into fixed income, into bonds. That means the bond price goes up and the yield comes down. So that could happen, but if rates are rising under that scenario that he’s suggesting, is that we could see potentially if the market is going to be better, or the economy is going to be better, meaning we’re seeing more robust employment growth but also we’re seeing inflation moving potentially back up from where it is today. Well, that means likely the Fed would start to jump in. They would possibly look to increase the Fed funds rate. And as much as the Federal Reserve do not control interest rates, they can certainly have a — they can form a direction for them. They can impact them to a degree. So I think that that is a big range, certainly, but I’m looking at it on both sides of the coin, right? Good market or a bad market. But I wouldn’t say that it is more realistic, because I do not expect to see a lot of volatility in rates in 2026. In fact, in 2025, we saw the lowest volatility levels, as in, the annual high and low of rates, we’ve seen in many years. So less volatile. I think they’re just looking at, it could be this, but it could be that.

Hartnett

Matthew, your optimistic forecast combines three things we don’t often see together: rising sales, improving affordability and moderate price growth. What makes that combination possible in 2026, and what would need to go wrong for that outlook to change?

Gardner

Well, yes, I certainly, when it comes to the U.S. housing market I am, for want of a better word, a glass-half-full economist. Well, I mean, as we discussed, my forecasts, other than for rates to fall a bit more than others expect, I’m not really far adrift from the consensus. Sales in 2023 and 2024 weren’t only disappointing, but they were well below the average levels we’ve seen from, you know, a 20 year period from 1989 to 2019. Sales over the last two years were below the number that we saw during the financial crisis. So can we get better? Well, it’s very hard to get worse. But the biggest thing is that the big numbers, the huge levels of sales we saw in 2020, certainly in 2021, that pulled a lot of demand forward. And of course, rates jumped in 2022, which, when you think about it, if you’ve got less demand because people had already bought, you’ve also seen mortgage rates doubling, that’s going to slow the market down even further. That caused a drag on sales. I think we’re over that now and we’re starting or continuing to create new households again. I think we’ve got a market out there that is now saying, well, I was hoping for rates to drop back down to 5 or 4% again. I know that’s not going to happen. Therefore, I’m going to buy now because for a lot of people, quite frankly, even if we see a very modest increase in sale prices, there’s going to be a share of people that if they don’t buy now, they won’t be able to afford to buy later on. So I think there’s going to be better demand. So we can see rising sales because of better demand. Moderate price growth — well, we can see modest price growth even though there are some issues with affordability, because the affordability concern comes very much — and it’s very much centered around — first-time buyers. You see, for us that have owned our homes for a reasonable length of time, we’ve made a bunch of money on it and affordability is less of an issue. But the affordability improving can come from lower asking prices. So I think you can actually see sales rising, modest price growth and affordability improving. But again, it’s going to be very much geographically defined. But those things can happen, and I believe that they will.

What would need to go wrong for my outlook to change? Yes, it would have to be rates for some reason or other jumping up. I find that remarkably unlikely. I don’t think that would happen. Price growth jumping to a point whereby affordability declines further? I don’t see that happening either. So I think all in all, modest improvement across the board is one that is the most likely scenario. But of course, who knows what might come around the corner. Certainly, I think that comments being made by the administration could have an impact on the equity markets and on the global markets as well, so not sure about that. We’ve obviously got a new fed chair coming in. We don’t know who it is, although I’ve got a pretty good guess. And so there’s going to be some concerns there as to whether the Fed will continue to be independent. That can have an issue on financial markets as well. So there are some geopolitical potential hiccups out there, but but in general, I believe that as long as we do not head into any form of major economic downturn, slow and steady is the way.

Hartnett

All right Matthew, to wrap this up, if you had to describe the 2026 housing market in one word, what would it be and why?

Gardner

I would say clarity. Yes, clarity. And why would I say that? I think that there’s a lot of uncertainty, really, quite frankly, going through Covid, coming out of Covid. We weren’t sure what was going to be happening. We saw rates plummet. Wonderful. But then they skyrocketed. Not good. People out there saying, isn’t this 2008 all over again? So I think that, yeah, I think that the market will be less opaque, in 2026. We’ll see some more clarity. And again, for people understanding the fact that for 98% of us, buying a home is the most expensive thing we ever buy in our lives, but if we’re making that decision, we want to be sure about it. So I think we’ll see more clarity and clarity will allow, I believe, prices to rise, transactions to rise. Not to the levels that I’m sure brokers would like, but they will be better in 2026 than 2025 because there will be, from a buyer’s perspective and indeed from a seller’s perspective, more clarity in the U.S. housing market.

Hartnett

All right, Matthew, thanks for breaking this down. And for all our sakes, fingers crossed that your predictions, your optimistic predictions, come true.

Gardner

I’m always helpful — hopeful, as well as helpful. But I appreciate that, Anne, and everyone out there have a great new year. Take care.