Current Market Data

House prices, however, continued to rise, marking the 130th consecutive month for price gains, the longest streak on record, the National Association of REALTORS® said.

More buyers have entered the market in the past four weeks as mortgage rates fell.

The increase in builder confidence breaks a string of 12 straight monthly declines in the NAHB/Wells Fargo Housing Market Index.

Redfin attributes the drop to the record high mortgage rates, recession concerns, record low inventory, extreme winter weather and the holiday slowdown.

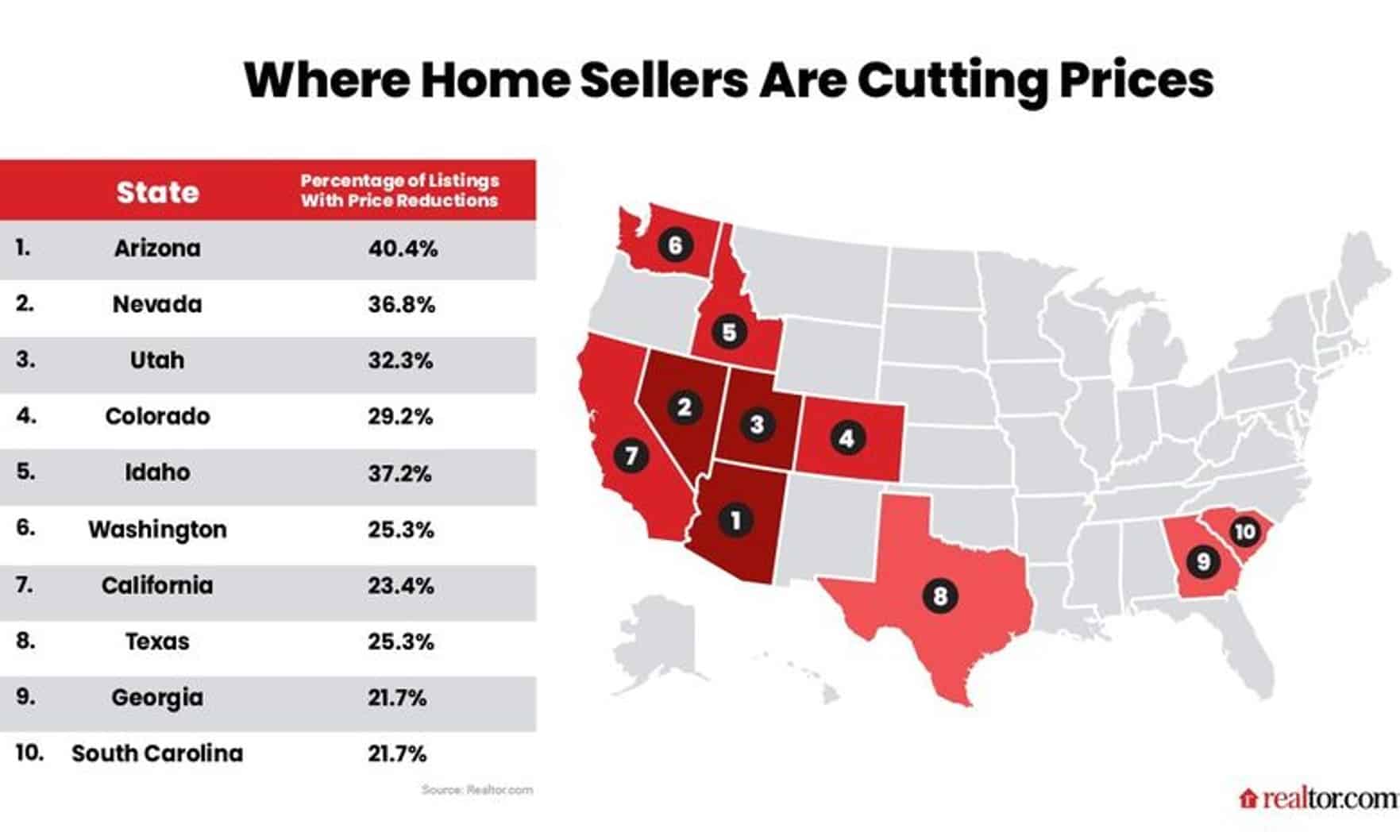

Geographically, the largest home-price increases took place in the Southeast, led by Florida (18%), South Carolina (13.9%) and Georgia (13.6%), CoreLogic reported, citing its November Home Price Insights report.

Regionally, the pending-sales index fell 7.9% month over month in the Northeast, 6.6% in the Midwest, 2.3% in the South and 0.9% in the West.

At the same time, the median sales price of a new house slid to $471,200 from $484,700 in October and $430,300 a year earlier, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

The month-over-month decline in sales came as prices rose for the 129th consecutive month, the National Association of REALTORS® said.

New-home permits fell 11.2% month over month, while housing completions jumped 10.8% in what one observer said could have “worrisome” long-term consequences for the nation’s housing supply.

Current real estate market conditions have not discouraged buyers from their plans of homeownership, according to a new survey from RE/MAX.

The 30-year fixed-rate inched to 6.42%, which is still close to the lowest rate in a month, the group said.

Homes are lingering on the market longer, up 15% from last year during the four weeks ended Dec. 4, marking the largest uptick in home supply since 2015.

A report from Realtor.com shows that many areas that experienced substantial growth during the pandemic are now posting some of the country’s steepest price reductions.

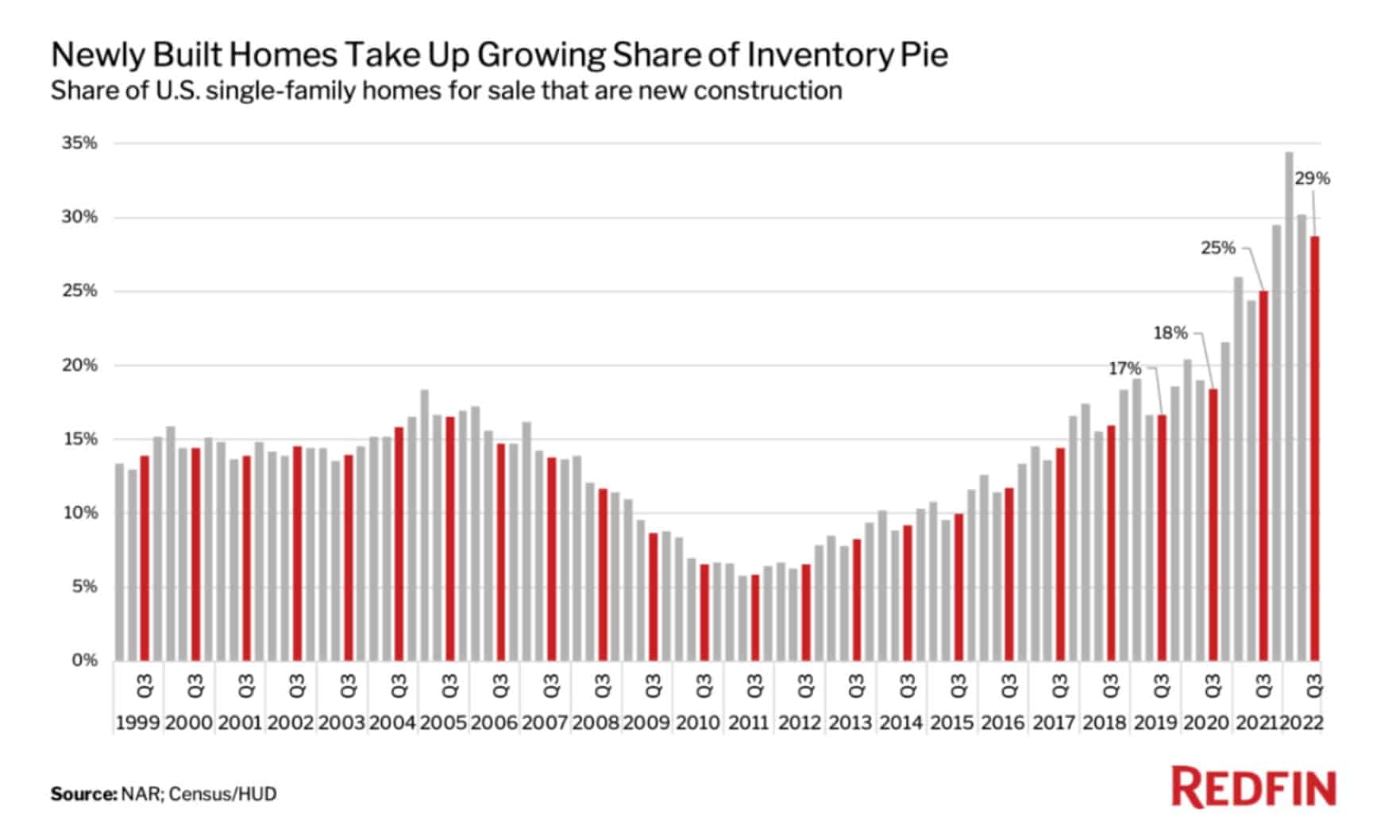

A report from Redfin shows that 29% of single-family homes for sale in the U.S. were new constructions in the third quarter of 2022.

Homebuyer demand is rising as mortgage rates continue to decline, according to a new Redfin report.

Data from the PEW Trust shows that investment companies make up approximately a quarter of the entire single-family home market across the U.S.