Trends

For data-driven stories, to appear under “Trends” menu

The S&P CoreLogic Case-Shiller U.S. National Home Price Index has hit a new record for six of the last 12 months, as demand remains strong in the face of tight inventory.

At the same time, the median price of a new home sold in April declined as well.

New-home construction jumped 5.7% month over month after a soft March, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

According to a new report from RentCafe, hotels have overtaken offices as the most likely spaces to be converted into new apartments.

In 2020, median renovation spending was $15,000. That amount increased by 60% in three years, with the median home renovation costing $24,000 in 2023.

Prospective sellers should prepare to jump on the market — the week of April 14 through 20 will be the best time to sell this year.

Sales rose 9.5% from January to a seasonally adjusted annual rate of 4.38 million.

There’s a reason many homeowners opt for neutral shades when trying to sell their house — certain flashy colors may be off-putting to buyers.

Many buyers entered the housing market for the first time in 2023. But who were these first-timers, and what did their homebuying experience look like?

Location, location, location … at least that’s how the old real estate adage goes, right?

The median existing-home price for all housing types was $379,100, up 5.1% from $360,800 a year before.

Home might really be where the heart is. According to a new Zillow survey, 42% of recent homebuyers reported finding love after buying their new home.

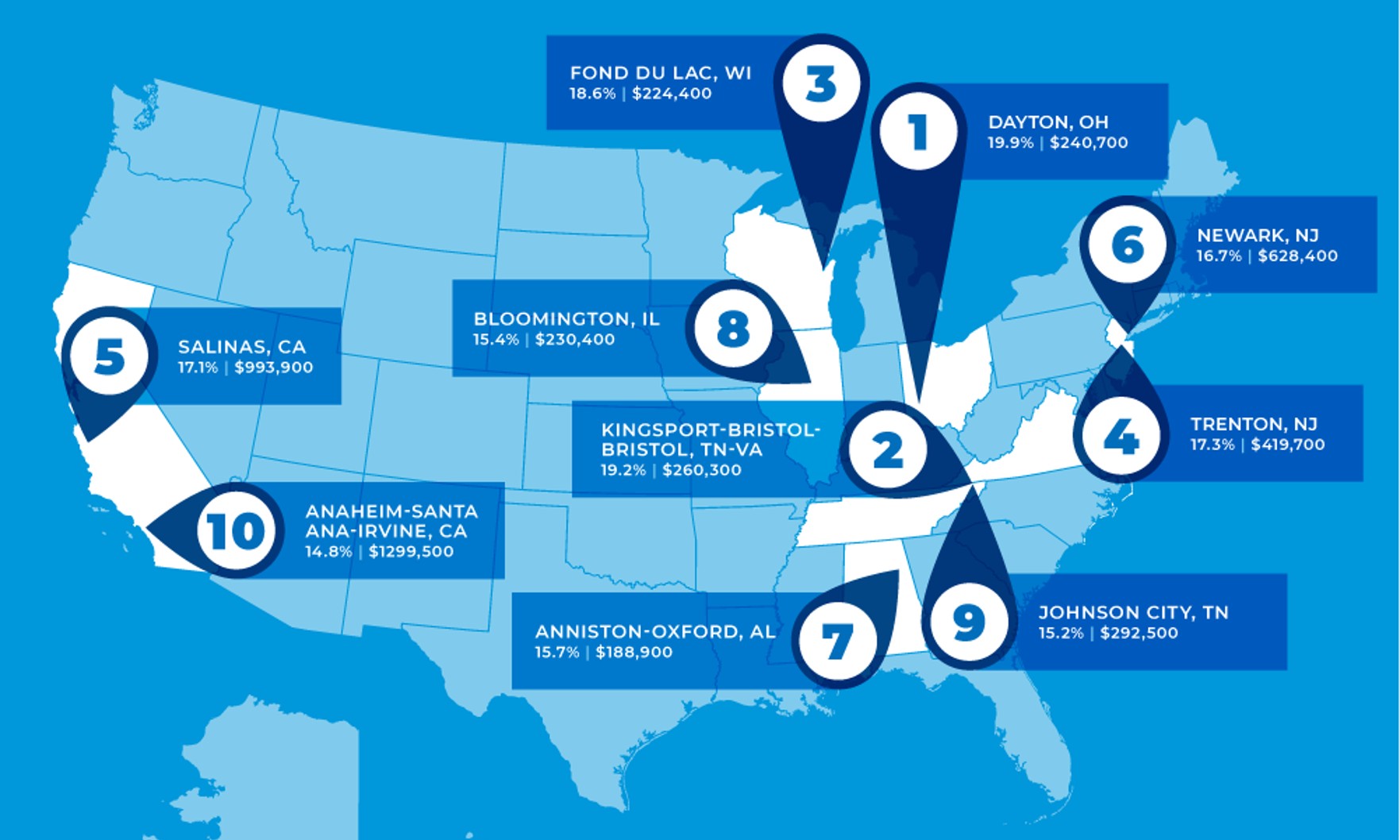

Single-family home sales prices increased in 189 out of 221 metro areas analyzed, with the median single-family price in the country rising 3.5% year over year to $391,700.

Pending home sales rose 8.3% month over month, the National Association of REALTORS® said, marking the largest monthly jump since 2020.

Declining interest rates spurred the increase.

Notably, renovators are less likely than they were a year ago to undergo kitchen modifications for the purpose of improving the home’s resale value.