Lending

Fannie Mae also reduced its forecasts for home sales in 2025 and 2026.

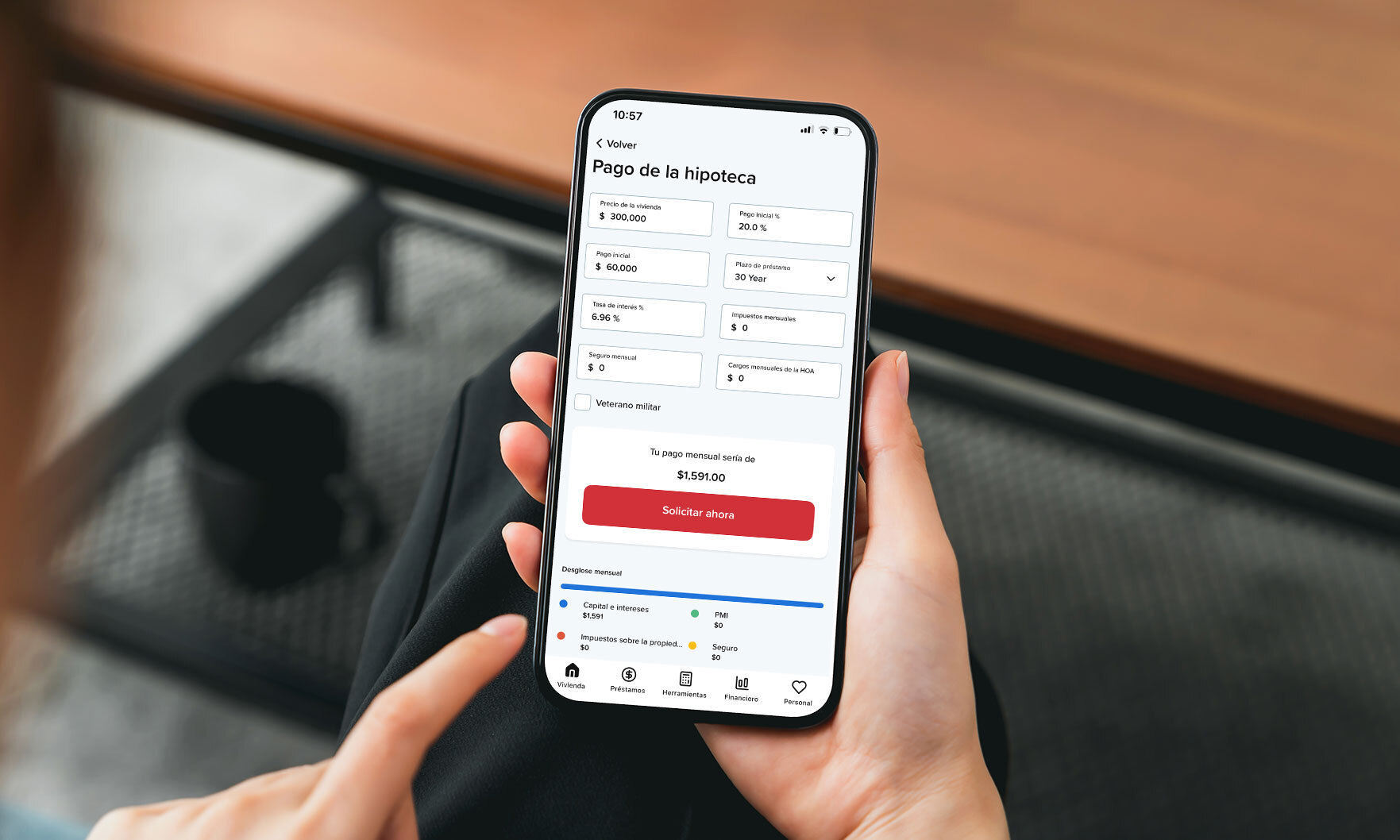

Rate has launched the first fully integrated Spanish-language mobile app from a U.S. mortgage lender.

The move was widely anticipated and is expected to be followed by additional cuts this year.

The jump in mortgage activity was driven in large part by refinancings, which surged 58% in the week ended Sept. 12.

The surge comes as the rate on a 30-year fixed-rate mortgage fell to its lowest level since October 2024.

Despite the decrease in borrowing costs, the Mortgage Bankers Association’s Market Composite Index showed a decrease in mortgage applications in the week ended Aug. 29.

The law helps delinquent VA borrowers and allows them to pay buyer-agent commissions when house shopping.

Purchase applications slowed to their lowest level since May as economic worries dampened activity, the Mortgage Bankers Association said.

The FICO alternative is expected to greatly expand the number of eligible borrowers by allowing rent and utility payments to count toward a credit score.

Purchase applications hit their highest level since February 2023.

The Mortgage Bankers Association said the post-Memorial Day increase came despite economic uncertainty and largely static interest rates.

The most recent Weekly Mortgage Applications Survey shows homebuyer activity continued despite the economic uncertainty.

The average 30-year mortgage saw its contract interest rate jump to 6.90% from 6.81% the week before, the Mortgage Bankers Association said.

The acquisition of the mortgage servicer comes on the heels of Rocket’s $1.75 billion deal for Redfin.

The NAHB/Wells Fargo Housing Market Index (HMI) rose seven points to 44, its second monthly increase in a row.

A 15% rise in applications for adjustable-rate mortgages drove overall mortgage applications higher in the most recent weekly survey.