News / Features

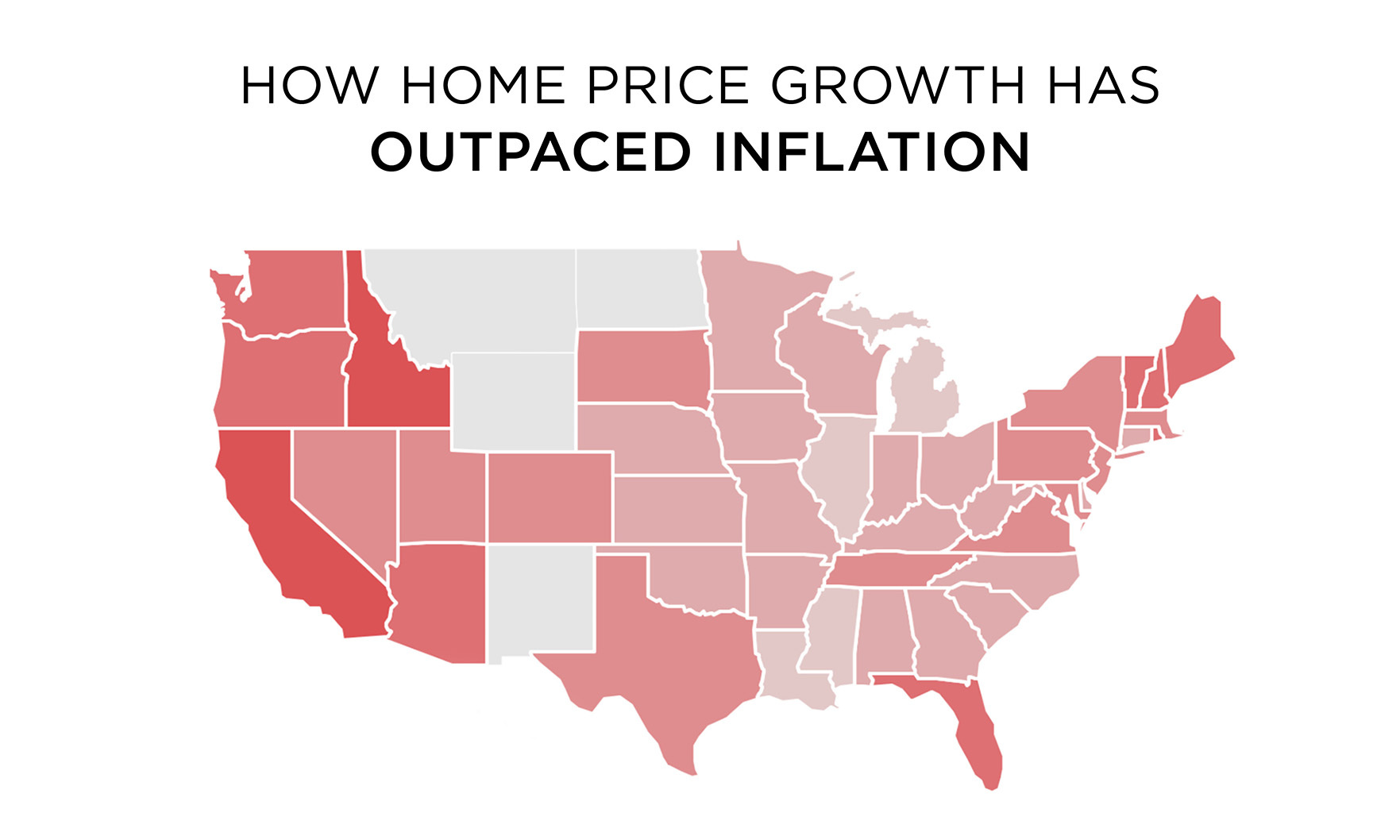

U.S. home prices are 24 times higher than they were in 1963 — while overall inflation is just 10 times higher.

Many buyers entered the housing market for the first time in 2023. But who were these first-timers, and what did their homebuying experience look like?

Willis previously served as Keller Williams president from 2002 to 2005 and CEO from 2005 to 2015.

Deputy Secretary Adrianne Todman will take over as acting secretary on Marcia Fudge’s last day, March 22.

NAR President Kevin Sears also raised concerns about Biden Administration regulations that could create hurdles to affordability.

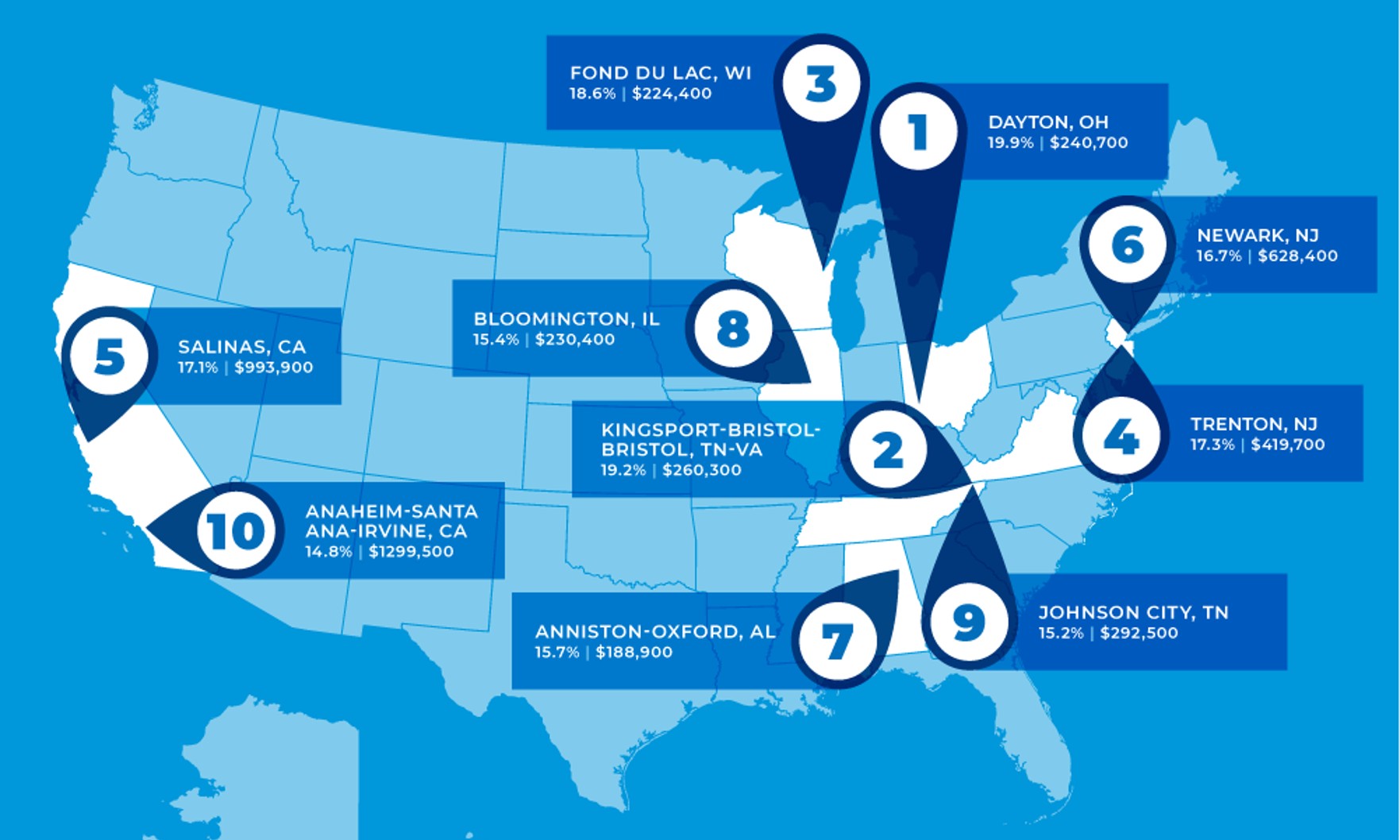

Location, location, location … at least that’s how the old real estate adage goes, right?

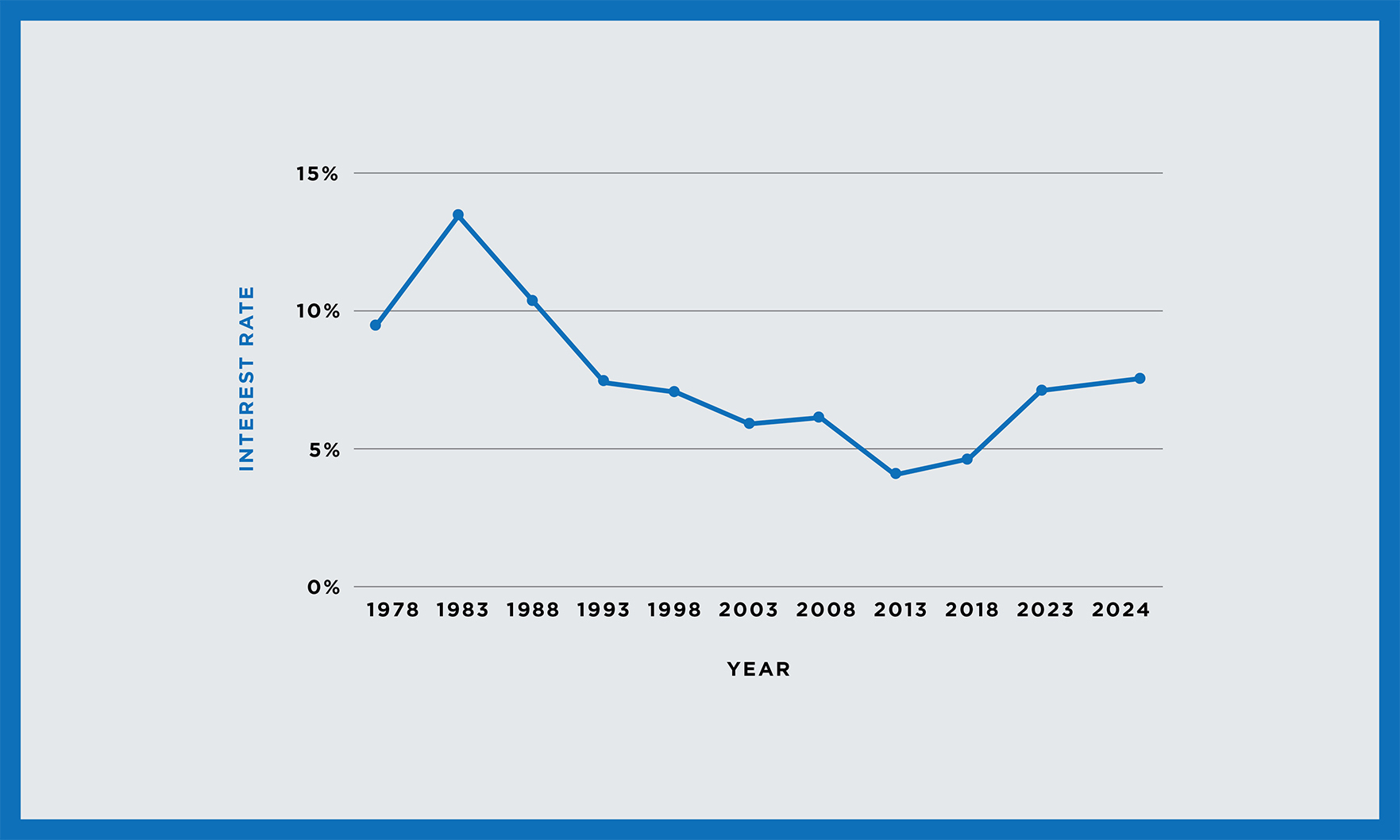

If your buyer is having a hard time moving on from 2021 and accepting the reality of today’s rates, a history lesson may help.

The crown jewel of architect Michael Reynolds’ sustainable vision, Vallecitos is a passive solar home within the Greater World Earthship Community, the world’s largest, legal off-grid subdivision.

Lower mortgage rates are the one thing that could draw buyers back into the housing market, according to a new survey from Realtor.com. The magic number? Around 5%.

This one-of-a-kind home was started in 1980 by contemporary artist Malcolm McCleod Brown.

The median existing-home price for all housing types was $379,100, up 5.1% from $360,800 a year before.

AgentEDU, which provides online real estate training courses, has partnered with The Greater Boston Association of Realtors (GBAR) to empower thousands of Boston-area agents with additional educational resources.

Single-family home sales prices increased in 189 out of 221 metro areas analyzed, with the median single-family price in the country rising 3.5% year over year to $391,700.

Months after being found liable in the now-famous Sitzer-Burnett trial, the Berkshire Hathaway affiliate is asking the U.S. Supreme Court to review a ruling related to the case.

The KW Real Estate Agent Professional Certificate comprises 124 hours of real estate education, including videos, readings, assessments and hands-on projects.

Pending home sales rose 8.3% month over month, the National Association of REALTORS® said, marking the largest monthly jump since 2020.