Current Market Data

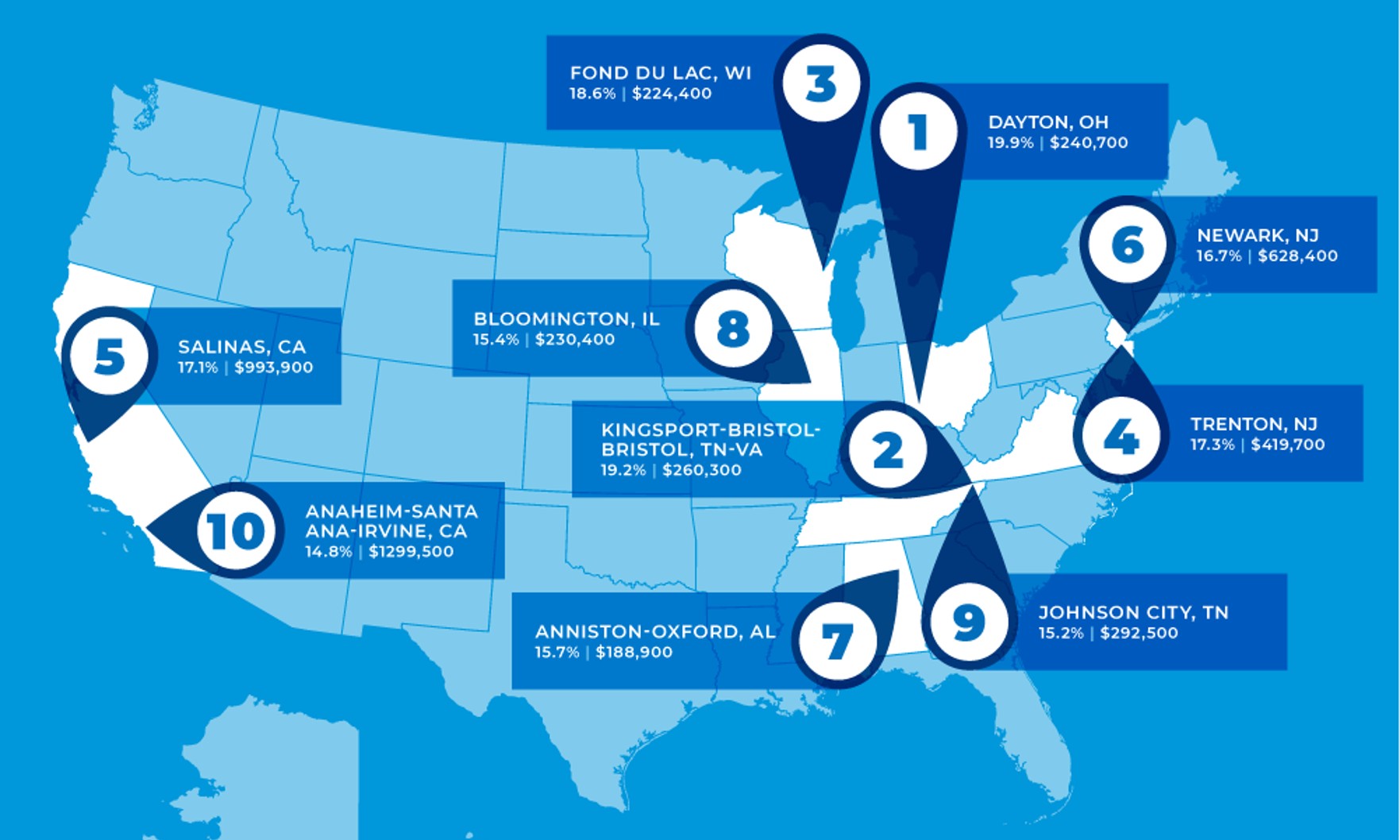

Location, location, location … at least that’s how the old real estate adage goes, right?

The median existing-home price for all housing types was $379,100, up 5.1% from $360,800 a year before.

Home might really be where the heart is. According to a new Zillow survey, 42% of recent homebuyers reported finding love after buying their new home.

Single-family home sales prices increased in 189 out of 221 metro areas analyzed, with the median single-family price in the country rising 3.5% year over year to $391,700.

Pending home sales rose 8.3% month over month, the National Association of REALTORS® said, marking the largest monthly jump since 2020.

Declining interest rates spurred the increase.

Notably, renovators are less likely than they were a year ago to undergo kitchen modifications for the purpose of improving the home’s resale value.

At the same time, the median sales price rose 4.4% to $382,600.

The NAHB/Wells Fargo Housing Market Index (HMI) rose seven points to 44, its second monthly increase in a row.

Nearly all millennials — 93% — say a volatile market is to blame for wrecking homebuying plans, with another 76% saying they expect the market to get worse before they’re able to make a purchase themselves.

With mortgage rates dropping to their lowest levels in almost a year, house hunters are returning to a market that many had shied away from in 2023.

CoreLogic expects prices to continue to grow through the year.

How will our homes evolve in the new year?

The only region of the U.S. that didn’t experience an annual decline in existing home sales was the Midwest, where sales were unchanged year over year.

Detached single-family homes remained the most popular type of housing, making up 79% of all home purchases during the past year.

A record number of homesellers are dropping their prices as buyers continue to feel the impact high mortgage rates are having on their wallets.