News / Features

“Latinos are more mortgage ready. Latinos have made strides in income and are more educated in the homebuying process,” said Nidia Fromenta Peguero of Century 21 North East in Danvers, Massachusetts. “They don’t want to rent anymore.”

The Mortgage Bankers Association noted the increase in borrowing activity came despite the 30-year fixed mortgage rate climbing to its highest level since November 2022.

Vice President of Association Affairs Jennifer Wauhob brings over a decade of experience to her new role with NAR.

In January, home prices were up 5.5% annually and down 0.2% monthly, CoreLogic reported, citing its monthly Home Price Insights report.

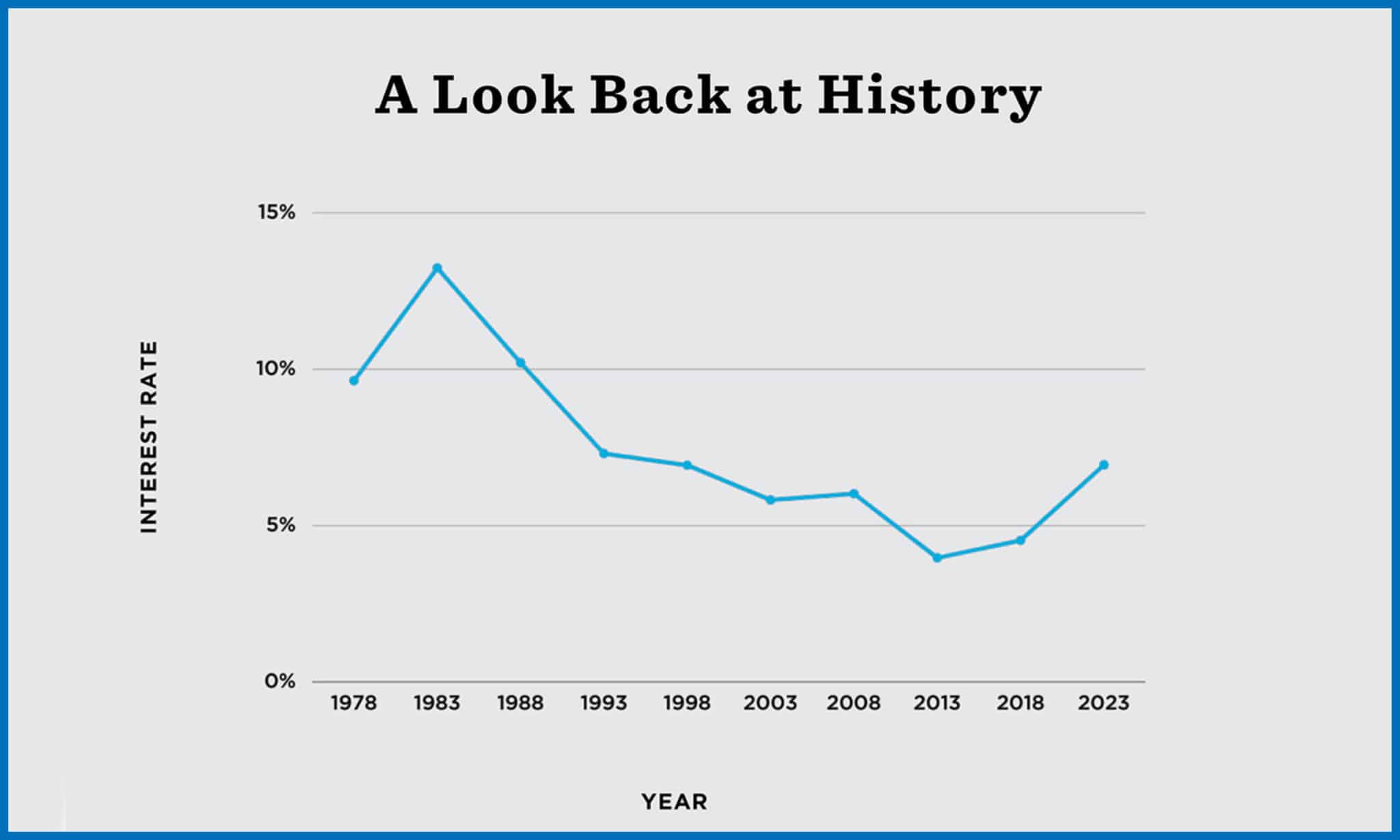

Keeping things in historical perspective can be tough when mortgage rates have roughly doubled in the last year. Mike Del Preto, a senior mortgage advisor at Fairway Independent Mortgage Corporation, helps provide a closer look at the numbers.

This massive Las Vegas home is all about luxury: six bedrooms, nine bathrooms, expansive views … and a secret portal to Italy.

Nearly 55 years after the Fair Housing Act was signed into law, Black homeownership still lags behind white homeownership.

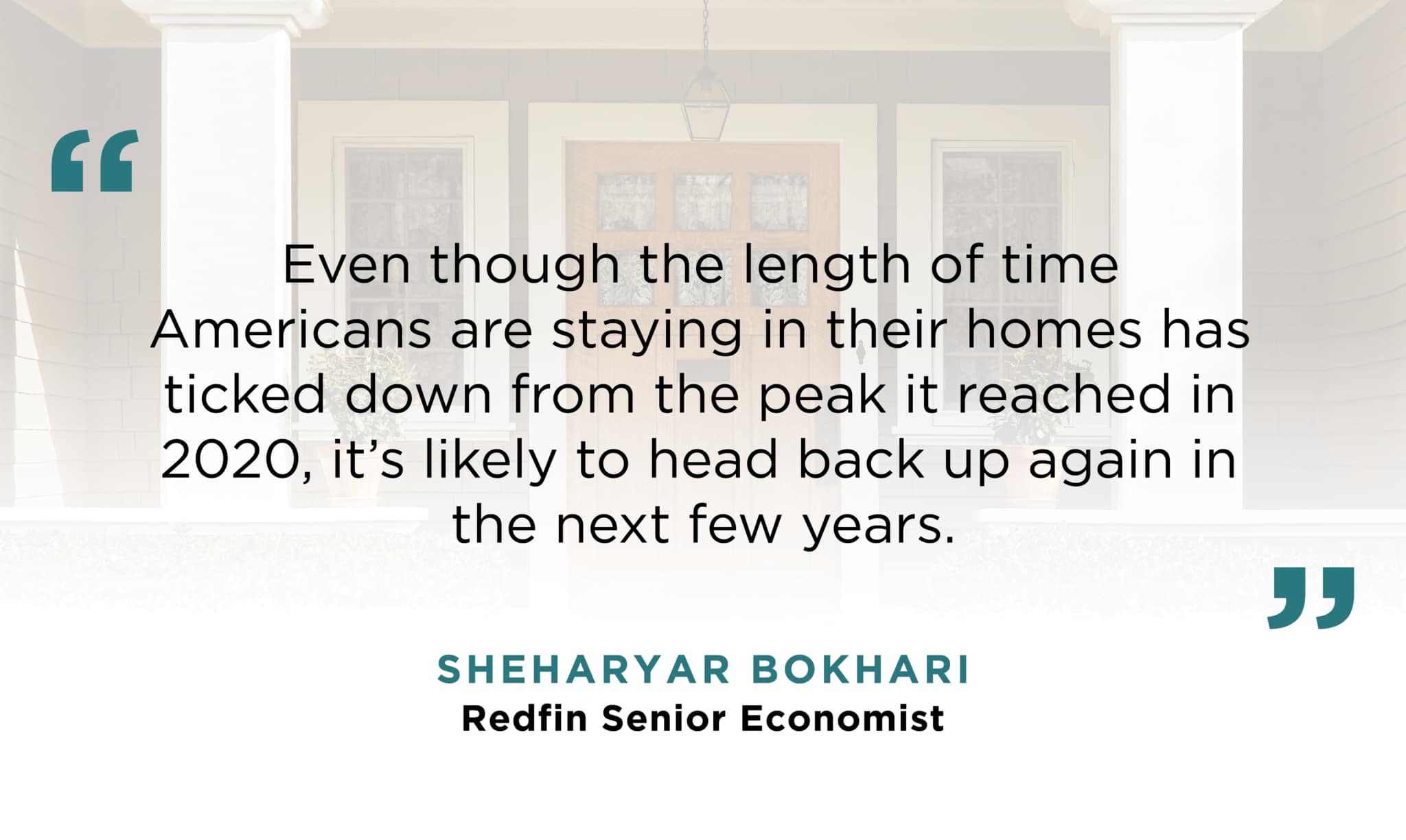

People staying in their homes longer is contributing to the lack of inventory that continues to impact buyers.

Many feel they could have made a higher profit if they’d made better decisions. But are those regrets valid?

The S&P CoreLogic Case-Shiller U.S. National Home Price Index rose 5.8% year-over-year in December, compared to a 7.6% gain in November.

The 8.1% month-over-month increase in the National Association of REALTORS® Pending Home Sales Index was the largest gain since June 2020.

The median sales price of a new home declined on both a monthly and yearly basis, however, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

Mortgage insurance premiums on loans backed by the Federal Housing Administration will drop from 0.85% to 0.55% beginning March 20.

The former Keller Williams lending unit will operate alongside Mutual of Omaha Mortgage’s existing mortgage divisions.

The 30-year fixed-rate mortgage averaged 6.32% as of Feb. 16, up from 6.12% a week before and 3.92% a year earlier.

The pace of mortgage applications fell 7.7% in the week ended Feb. 10, the Mortgage Bankers Association reported.