National News

Two recent reports from the National Association of REALTORS® examine the challenges faced by today’s homebuyers from both the consumer’s and the Realtor’s perspective.

New home listings are still on the rise, despite mortgage rates hitting the highest level in more than 20 years. And those high mortgage rates are pushing monthly housing payments higher than they’ve ever been.

House hunting was traditionally a couples’ game until Millennials and Gen Zers came into the picture. Now, many young individuals are plunging into the market solo.

Redfin said it will require many of its agents to leave NAR and the association has “forced an all-or-nothing choice on us,” and it would therefore “choose nothing.”

Canceled home-sales contracts hit their highest rate in almost a year as skittish homebuyers blanche at mortgage rates that are the highest they’ve been in more than 20 years

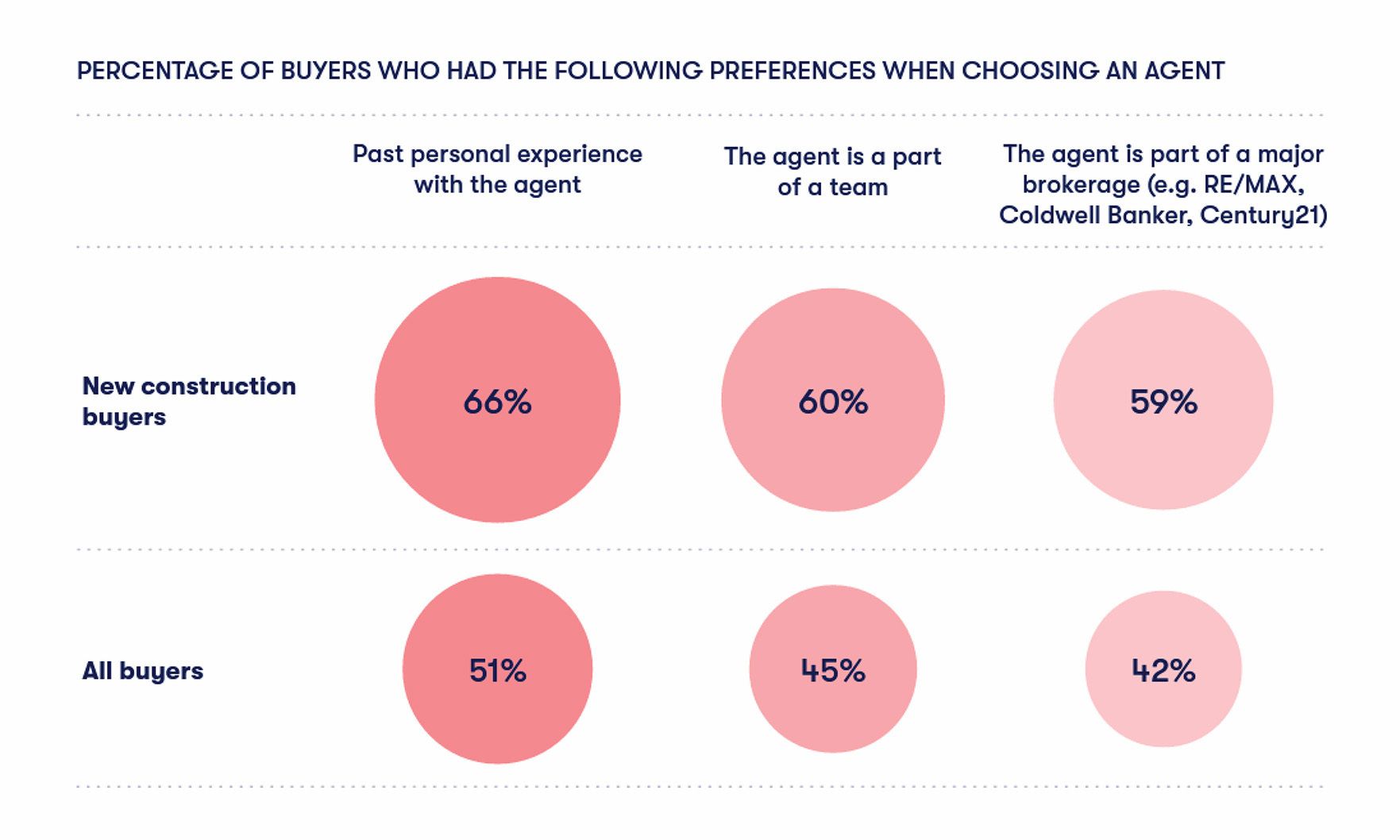

One of the biggest hurdles facing residential builders is raising awareness of their projects among prospective buyers, according to Zillow’s recently released new-construction consumer housing trends report.

Those looking to buy a house will be paying a premium as inventory continues to be an issue.

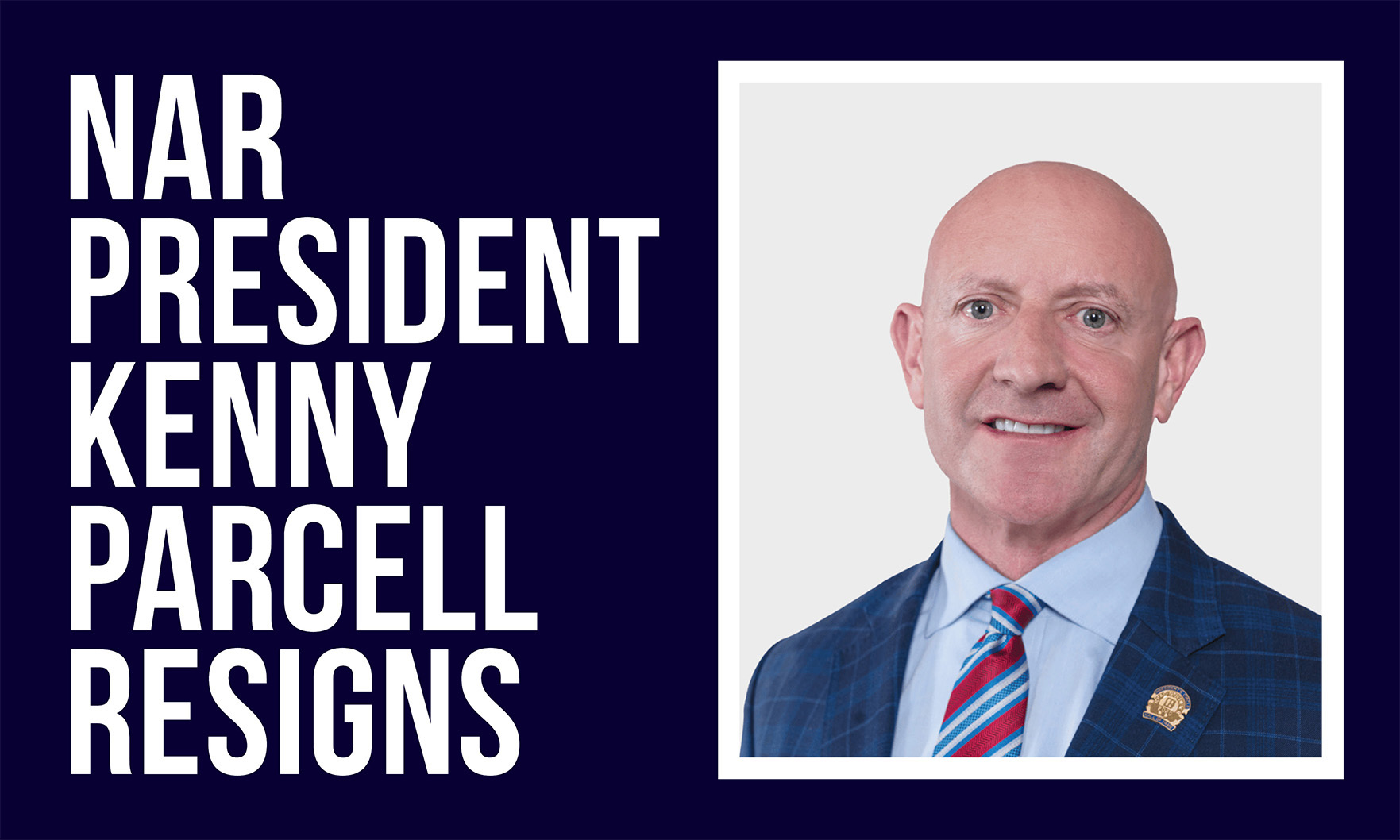

Kenny Parcell has resigned as president of the National Association of REALTORS® following a recent bombshell report by the New York Times into allegations of sexual harassment within the organization.

MLS freeze strikes agents in Florida, Massachusetts, Indiana, New York, California and elsewhere.

Single-family home permits and completions, meanwhile, also rose, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Homes where the loan-to-value ratio is 50% or lower — equity-rich homes — are on the rise, which is good news for homeowners.

Meanwhile, July’s home sale prices had their highest increase since November.

For the first time in almost 12 months, the average U.S. home is selling above its asking price, as the average sale-to-list price ratio hit 100.1% earlier this month

Set to debut on July 17, “Drive with NAR: The Safety Series” will be hosted by former real estate agent and expert, Tracey Hawkins.

The National Association of REALTORS® has been named in a new lawsuit by Janelle Brevard, the organization’s former chief storyteller. NAR President Kenny Parcell is named multiple times in the complaint.

According to the NAHB, The New American Home® represents the latest in luxury real estate. It was unveiled at their recent tradeshow.